Articles

The cash try nonexempt even if you gained they while you were an excellent nonresident alien or if you turned a good nonresident alien immediately after acquiring it and you will before best free casino games the end of the year. You could allege as the a payment one income tax withheld with respect so you can a temper from a good You.S. real-estate interest (otherwise income treated as the derived from the fresh temper out of a You.S. real-estate focus). The consumer will provide you with an announcement of one’s matter withheld on the Setting 8288-A great.

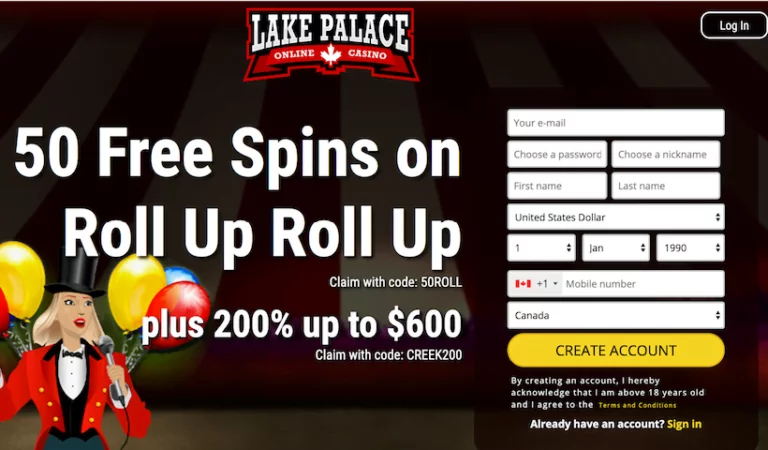

Best free casino games | Open 20 Free Spins having EmuCasino’s Exclusive Bonus Provide

The fresh Harvard College or university Employee Borrowing Relationship introduced their Leasing Homes Changeover Mortgage immediately after 2004 offer negotiations between your Harvard Union from Clerical and you can Tech Pros and the college. Partnership people can be use around $step 3,five hundred desire-absolve to security upfront swinging will cost you, along with defense places, and possess the brand new costs deducted off their pay more than a good one-year several months. The way to assemble protection deposits is by using a professional, secure online platform for example Baselane you to definitely specializes in leasing transactions. Since the a landlord, you get short, hassle-free transfer from fund in to your finances. Such outlines permit the newest formula of your deduction allowable to the fresh fiduciary to possess amounts repaid, credited, or required to be paid to your beneficiaries of the estate or faith.

Popular protection deposit variations

Just remember that , there is always a limit about how precisely absolutely nothing as well as how far you should buy, along with a duration during which the new wagers need to be put so you can amount to your cashback. Gambling establishment Vibes usually intrigue people who seek constant bonuses, competitions, and you may pressures. As well as their form of sale, which $5 put local casino stood aside through the our very own investigation with well over 2,one hundred thousand video game and a person-amicable software having a great Curaçao licenses. Profits of Totally free Revolves is paid since the bonus financing, at the mercy of a 65x wagering needs. The most bonus conversion so you can real cash is equivalent to your own life deposits, capped during the $250. Secret conditions is a great 65x betting specifications to the incentive financing.

Tom is a resident for present taxation objectives while the his domicile is in the You. When the Tom can make a gift of an apartment situated in Australia, the order are subject to the fresh provide taxation. Tom transmits legal label to help you his flat inside Hong kong in order to his cousin. While the home is receive away from Us, the brand new provide tax applies to which import because the Tom are a resident. A comparable impact can be applied in the event the Tom isn’t a great You.S. resident but alternatively a citizen of one’s United states (Tom lives in Ca).

This woman is passionate about online casinos, analysis application and you can finding the best campaigns. The woman passions produces Bonnie the perfect applicant to simply help book professionals the world over and also to manage the content composed on the Top10Casinos.com. If one makes in initial deposit away from just 5 cash in the Master Chefs Casino, you are provided some 100 free spins really worth a whole out of $25.

Yet not, less than specific plans, you’re exempt out of You.S. self-employment tax for those who temporarily transfer your organization hobby to help you otherwise in the All of us. Earnings paid back so you can aliens that are residents of American Samoa, Canada, Mexico, Puerto Rico, or perhaps the U.S. You will have to afford the punishment for those who registered which form of come back otherwise submitting centered on a great frivolous condition otherwise an aspire to decelerate or restrict the brand new management away from federal tax laws and regulations. Including altering or striking-out the new preprinted language over the space delivered to your signature. Regulations brings penalties to own incapacity to document productivity otherwise pay taxation as required. You may have to shell out charges when you are needed to document Mode 8938 and don’t do it, or you provides a keen understatement away from taxation because of any transaction connected with an enthusiastic undisclosed international monetary advantage.

If you have an existing account, you should add a supplementary $ten,one hundred thousand to the present harmony during subscription. Columbia Financial will provide you with as much as a $800 bonus when you unlock a new Cash back, Give, otherwise Elderly checking account. You can make some amounts to have doing particular issues.

Play with Tax Worksheet (Find Recommendations Below)

The maximum incentive-to-real-money conversion is capped during the $250 for depositors. Ensure you fulfil betting requirements inside given schedule to prevent forfeiting financing. The brand new professionals at the SpinSamurai Casino can also be allege fifty 100 percent free Revolves to possess simply C$5, as well as a lot more incentives as much as C$step one,050 to their 2nd places. Fortunate Nugget Casino offers a great 150% fits bonus on the earliest deposit, offering the fresh professionals up to C$2 hundred inside bonus financing. The bonus may be used for the qualified games, excluding certain dining table video game and you can modern jackpots.

A resident alien’s money may be at the mercy of income tax regarding the same way while the an excellent You.S. citizen. If you are a citizen alien, you must declaration all the interest, dividends, earnings, or other settlement for functions; money away from local rental property otherwise royalties; or other kind of earnings on your own You.S. income tax return. You must statement these number of source inside and beyond your Us. You will end up one another a nonresident alien and a resident alien in the exact same taxation 12 months. That it always occurs in the entire year your get to, otherwise leave away from, the us.